What's Next for Artificial Intelligence in Tax Firms

Practical ways AI is landing in tax firms now. Covering research, preparation, workflow, and advisory, with a vendor checklist and §7216 guidance.

Recently, I visited a 40-year-old tax firm that serves roughly 800 clients. The partners have no website, no marketing funnel, and no automation stack. Clients arrive with grocery bags full of receipts, and the team enters every data point by hand before preparing P&Ls, filing sales tax, and running payroll through ADP. When I asked why the firm hadn’t embraced digitization or AI, the owner said he would “immediately embrace any new service that made tasks faster and didn’t cost more than the manual process.” His clients often don’t own computers, so expecting scanned receipts is unrealistic. His staff already “know the clients and can accurately enter the data into our accounting software.” In his words: “Think about scanning all receipts and then having software analyze them. That takes longer than our staff sorting through the receipts.”

Who am I to judge a million dollar business that runs on a single ProSeries subscription and high trust. But also: this firm is not rejecting technology, it’s rejecting technology that fails to beat human speed, accuracy, and cost, and that risks the relationships they’ve built over four decades.

The story also dispels a myth: not every firm that skips automation is behind. This “old school” shop operates a $1M+ practice with almost zero software overhead, lightning-fast staff, and deep credibility with clients.

So are we at a point where even firms like this can materially benefit from AI? My answer: yes. The question is no longer whether AI will show up in your firm, it’s how quickly you can implement it to gain an advantage and which vendor you can trust to get you there.

I've watched AI mature inside other complex arenas, like contact centers. At Fanatics, AI-driven conversational systems now handle 25,000 calls per day, reduce headcount by roughly 250 agents, and still deliver the metric that matters most, fast resolution. Customers care about outcomes; AI keeps improving at resolving problems with human-level tone and context.

Tax conversations are nuanced and infrequent, so the front line may evolve more slowly. But onboarding, research, preparation, and review are already primed for AI leverage. Partners face tight capacity, denser codes, and fewer qualified candidates. Firms that deploy AI strategically are winning on efficiency, talent retention, and client experience.

Underneath the excitement lives a harder question: how do you use AI as a competitive advantage without risking client data, compliance, or reputation?

This article breaks down what's real, what's hype, and what's next across four primary workflows, Research, Preparation & Review, Workflow Automation, and Planning & Advisory, along with a practical approach to selecting vendors, piloting responsibly, and sharing the wins.

1. The Inflection Point: From Experimentation to Expectations

For the first time in 2025, AI will no longer feel like a novelty during filing season, it’s becoming foundational to how serious firms operate.

- The AICPA and CPA.com now call AI “a strategic imperative,” and that language is showing up in budgets.

- Firms such as RSM and BDO aren’t dabbling anymore; they’re funding internal AI development and embedding automation across workflows.

- Incumbents (Thomson Reuters, Wolters Kluwer, Intuit) frame AI as their next growth engine, while challengers like TaxGPT, Blue J, and Bizora ship purpose-built models for tax work, not generic use.

The shift is driven by data, not hype:

- The CPA pipeline is collapsing; retirements alone would shrink the profession by nearly 70% over the next decade, per CPAClub’s analysis of AICPA data.

- Hiring costs keep climbing while the candidate pool is shrinking 50–75% year over year.

- Clients demand faster turnaround, real-time visibility, and advisory guidance well beyond compliance.

- Section 7216 and broader data-security rules make “I tried ChatGPT” a liability without vetted vendors and consent workflows, as detailed in The Tax Adviser’s overview of Sec. 7216 obligations. For internal guidance, see our §7216 deep dive.

AI becomes the leverage point: getting more output from the people you already trust. Firms that automate repetitive work and redirect teams toward analysis, planning, and client communication quietly move to the front. The edge isn’t simply owning tech, it’s creating an environment where professionals spend time on the high-value work clients actually buy. This is exactly what I have seen in contact center technology: companies used to outsource customer support to low cost countries with mixed success (understatement, who doesn't have a story of a bad experiece calling support?) but now they hire SME's on-shore and surround them with AI. AI handles the high volume, low EQ calls, and when needed, true SME's step in to help.

2. Four domains of AI in tax firms

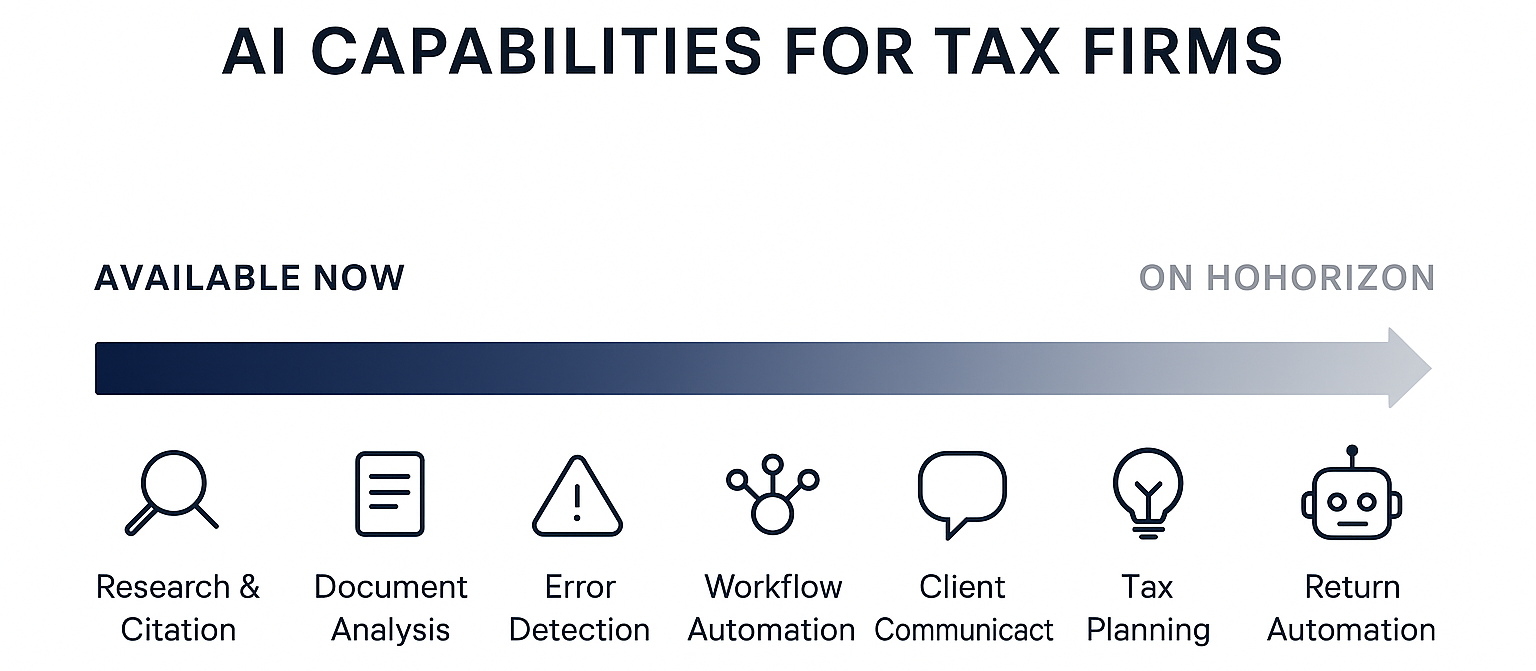

AI in tax isn’t monolithic. Different technologies solve different problems, understanding those distinctions keeps investments focused.

1. Tax Research

AI-assisted research tools train on authoritative sources, the Internal Revenue Code, Treasury regulations, IRS rulings, and case law, to surface relevant guidance in seconds. Unlike generic LLMs, they are curated, citation-based, and audit-friendly.

Representative tools

- Thomson Reuters CoCouncil for trusted summaries tied to citations.

- Blue J for scenario modeling and outcome prediction.

- Bizora for complex federal, state, and international questions with citation-backed reasoning, document parsing, and scenario modeling.

- TaxGPT for cited tax research, memo drafting, and its signature “Tax Matrix” comparisons.

Use cases

- Get instant, citation-backed answers to complex federal, state, and local tax questions.

- Pull relevant IRC sections, regs, rulings, and cases tied to specific fact patterns.

- Generate first-draft memos with citations and structured reasoning.

- Summarize long or technical documents (regs, court opinions, IRS publications).

- Produce client-ready explanations that translate dense tax law into plain English.

- Compare state rules, thresholds, nexus standards, apportionment methods, or filing positions.

- Identify precedent and supporting authorities before audits, exams, or planning meetings.

- Automatically generate source lists or “reading paths” for deeper review.

- Highlight risks, ambiguities, and defensible positions with links back to primary sources.

- Extract and restate key rules from uploaded PDFs or prior-year returns to support research.

- Maintain and reuse client-specific context to tailor ongoing research responses.

- Speed up issue-spotting by condensing hours of manual lookup into minutes.

2. Preparation

Most automation budgets land here. Firms are moving beyond basic data entry toward semi-automated workflows: AI pulls data from W-2s, 1099s, K-1s, and prior returns, maps everything into prep software, and produces linked workpapers plus review flags so humans focus on judgment instead of transcription.

Examples of solutions

- Juno, Now integrated with TaxDome. The integrated flow lets staff send docs from TaxDome to Juno, which extracts relevant data, draft returns, and push the work back into TaxDome-supported software (Lacerte, ProConnect, Drake, UltraTax, with CCH Axcess and others in beta).

- Black Ore, Targets CPA firms with 1040 automation spanning ingestion, drafting, workpapers, and partner review, processed in U.S.-based, SOC-2 environments.

- Solomon, Positions itself as an analyzer of source documents that prepares returns directly inside the firm's current software stack.

Emerging trends

- Today’s focus sits on Form 1040 and other high-volume work because the inputs are standardized and predictable.

- The next wave targets 1120/1065/990 packages, but varied schedules, elections, and data structures make full automation harder.

Differentiation among vendors

- End-to-end linking of source documents to prepared returns.

- Automated carryover logic and entity history recognition.

- Review-ready workpaper bundles with exception flags.

Impact

- Junior staff spend less effort on manual entry and mapping.

- Reviewers resolve flagged exceptions, missing schedules, and inconsistent carryovers earlier.

- Firms compress preparation cycles, produce more returns per billable hour, or lower fixed labor cost per return.

3. Workflow Automation

Beyond returns lies the unglamorous infrastructure: intake, communication, review, billing, and tracking. AI is starting to streamline this “work around the work.”

Representative tools

- Canopy, Karbon, Pixie, Corvee for reminders, summaries, and document requests.

- Thomson Reuters Practice CS and Wolters Kluwer Axcess Workflow for automation bridges between preparation and billing.

Use cases

- Auto-generate organizers, engagement letters, and 7216 consent packets.

- Auto-classify documents to the correct year, or auto-rename them based on content.

- Route tasks by complexity or deadline.

- Summarize client emails or extract tasks.

- Predict bottlenecks in the return pipeline.

Impact

- Workflow AI removes friction rather than replacing professionals.

- Firms adopting these tools see 10–25% faster turnaround, better responsiveness, and fewer missed deadlines.

4. Planning & Advisory

Once compliance is streamlined, the next expansion vector is advisory, where AI has the potential to lift margins and strengthen client relationships. Interest is high, but the market is still early: current tools cover slices of planning workflows, yet no "end-to-end AI financial planning" platform exists.

What AI can currently support

- Compare tax liability outcomes across states, entity types, or filing positions.

- Model tax impacts from relocations, ownership changes, or basic restructurings.

- Draft planning memos with citations and structured reasoning.

- Highlight potential opportunities (deductions, credits, elections) for human review.

- Translate complex tax rules into client-ready narratives.

These capabilities accelerate prep for advisory conversations and bring consistency to documentation, but humans still interpret and deliver the advice.

What AI cannot yet do

- Produce compliant multi-year tax projections.

- Deliver full financial plans, retirement roadmaps, or cash-flow models.

- Determine risk tolerance or product suitability.

- Seamlessly integrate wealth and tax planning data.

- Generate audit-ready conclusions without human oversight.

Despite prototypes and marketing claims, comprehensive planning remains a practitioner-led process with AI as a helper, not a replacement.

Why it matters for firms

As compliance gets automated, clients expect proactive guidance. AI acts as a force multiplier by speeding research, generating draft materials, and surfacing strategies that humans might miss. The firms that treat AI as an assistive layer, freeing advisors to analyze, explain, and present insights, will be best positioned to turn planning into durable revenue.

Choosing the Right AI Stack for 2026: Vendor Evaluation Checklist

AI Roadmap & Innovation

- ☐ Vendor publishes a roadmap with clear plans across all four functions (Research, Prep, Workflow, Advisory)

- ☐ Demonstrated pattern of shipping updates consistently (monthly or quarterly)

- ☐ Product vision covers the full tax lifecycle, not just a single workflow

- ☐ Uses a proprietary model or securely fine-tuned system, not a generic GPT wrapper

- ☐ Shows progress beyond 1040s (e.g., 1120, 1065, multi-state, trust/estate)

Security & Compliance

- ☐ SOC 2 or ISO 27001 certification (or in active audit)

- ☐ Section 7216-compliant consent workflows and documentation (see §7216 guide)

- ☐ Encryption in transit and at rest

- ☐ Data segregation (taxpayer data not co-mingled or used for training)

- ☐ Clear data retention and deletion policies

- ☐ No model training on client documents

Tax Software Integration

- ☐ Direct integration with your core prep system (Drake, ProSeries, Lacerte, UltraTax, CCH Axcess)

- ☐ Updated mapping for new form versions each tax year

- ☐ Supports two-way sync or direct import into returns

- ☐ Connects with your workflow tools (TaxDome, Karbon, Canopy), or better: can become your worflow tool

Product Capability

- ☐ Handles structured and unstructured documents (PDFs, scans, prior-year returns)

- ☐ Human-in-the-loop review mode for error checking

- ☐ Handles carryovers, entity-level adjustments, basis tracking

- ☐ Generates linked workpapers, bookmarked binders, and review trails

- ☐ Supports multi-state, multi-entity, and ownership-change scenarios

Scalability & Fit

- ☐ Works for the size, complexity, and seasonality of your firm

- ☐ Licensing model fits your staffing pattern (including seasonal staff)

- ☐ Offers admin controls, user permissions, and audit logs

- ☐ Has responsive support for peak-season issues

- ☐ Provides references from firms similar to yours

4. Frequently Asked Questions (AI Vendor Selection Edition)

What should I look for first when choosing an AI vendor?

Start with the roadmap, not the current feature list. Today’s tools excel in specific areas (research, extraction, workflow), but the firms that win choose vendors committed to supporting all four pillars - research, preparation, workflow, advisory. You don’t want five tools when one platform can evolve with you.

Why does an AI roadmap matter so much?

Because tax AI shifts every quarter. A vendor that only tackles research or 1040 extraction today may not help with multi-entity returns, workflow automation, or advisory next year. A credible, published roadmap prevents tool sprawl and keeps your stack future-proof.

How do I know if a vendor is secure?

Look for evidence, not buzzwords. Mature vendors provide:

- SOC 2 or ISO 27001 documentation

- Clear data retention/deletion policies

- §7216-aligned consent workflows

- Data isolation (no co-mingling or model training)

- Encryption in transit and at rest

If they can’t explain their controls, they’re not ready for professional tax data.

Do I need a vendor that uses its own model?

Not necessarily, but you do need a vendor running a proprietary or securely fine-tuned model, not a generic GPT wrapper. Public models without strict isolation create §7216 and confidentiality risk. Your vendor must control how the model is deployed, secured, and audited.

Should the vendor support business returns?

Yes. Most prep engines start with 1040s, but firms doing entity work need support for:

- 1120, 1120S, 1065, 990

- Multi-state scenarios

- Basis and carryover logic

- Entity-level adjustments

If a vendor can’t show progress beyond 1040-only, they’ll bottleneck advisory ambitions.

How important is tax software integration?

Critical. AI only delivers ROI when it pushes data directly into your prep system. Confirm support for your stack (Drake, ProSeries, Lacerte, UltraTax, CCH Axcess) and clarify whether integration is real-time, export/import, or manual.

How do I vet a vendor quickly?

Expect the following within five business days:

- Security whitepaper

- SOC 2 report (or audit-in-progress letter)

- §7216 documentation

- Sample outputs (anonymized)

- Product roadmap

- Prep-software integration details

If they can’t deliver, they’re not ready for sensitive workflows.

Can small firms afford AI?

Yes. Challenger tools usually offer per-user or per-return pricing, with pilots under $1,000/month. Smaller firms often see the fastest ROI by offsetting seasonal labor and review time.

Will AI replace preparers?

No. AI handles extraction, summarization, and comparison. Preparers still own interpretation, judgment, compliance risk, communication, and signatures. Treat AI as a co-pilot, not a replacement.

Can my firm simply use ChatGPT or another public LLM with custom prompts?

No. Public LLMs (ChatGPT, Claude, Gemini, etc.) are not §7216-compliant. Sending taxpayer data to a general-purpose system means:

- No lawful consent workflow

- No guaranteed data isolation or non-training

- No audit trail, SOC 2 controls, or contractual protection

Even “private modes” or “enterprise plans” don’t make public LLMs compliant. Any taxpayer info (names, income, EINs, W-2 images, K-1 data) routed through these systems creates §7216 risk.

To use LLMs safely, you need a vendor that:

- Runs the model in a restricted, isolated environment

- Signs a data-processing agreement covering taxpayer info

- Maintains SOC 2 / ISO 27001 controls

- Provides documented §7216 workflows/consent language

- Guarantees no training on your data

Public LLMs are useful for experimentation, never for production tax work.

Should I build my own local LLM to handle tax research?

Building your own local LLM can work if you need absolute data privacy or have strict regulatory requirements that prohibit cloud-based tools. However, the technical and maintenance overhead is significant: you’ll need to handle OCR, document parsing, model updates, security hardening, and compliance controls yourself.

For most firms, a better path is evaluating purpose-built tax AI vendors that already handle privacy, §7216 compliance, and IRS form updates. If you’re exploring DIY options, see our detailed breakdown of what it actually takes to build a local AI tax assistant, including cost, hardware requirements, and maintenance trade-offs.

For deeper technical guidance on AI implementation, data lineage, and governance, resources like MyUndoAI offer thorough, research-backed guides that respect your time and intelligence.

5. Next steps

AI’s trajectory inside tax firms mirrors earlier tech shifts: skepticism, targeted pilots, then rapid standardization, only faster. Waiting for perfection risks losing talent and premium clients to competitors already deploying AI across research, preparation, workflow, and planning. Firms that start using AI will have a competitive advantage over any other firm.

- Start with a narrow pilot (e.g., AI review for 1040 returns) to bank quick wins.

- Establish governance early so compliance and risk teams stay comfortable.

- Publicize successes in recruiting and client marketing to position your firm as progressive.

And don't stop there, AI can also play a huge role in your marketing. You don't need to outsource SEO, Social, web development anymore. AI can be your private Marketing firm for a fraction of the cost.

Give your opinion: AI in Tax & Wealth Firms Survey

Help us expand the benchmark behind articles like this. The AI in Tax & Wealth Firms 2025 survey takes under four minutes, keeps responses confidential, and gives you early access to the January findings. Add your firm’s adoption stats so peers can compare capacity, tooling, and governance playbooks and so we can highlight where AI is truly delivering value.